By John Kemp LONDON, March 3 (Reuters) – China’s coronavirus epidemic and the aggressive measures to contain it have shone a spotlight on its central role in global supply chains and as an engine of the world economy.

Severe industrial disruption in China now threatens to push the global economy into its deepest cyclical downturn since the financial crisis of 2008/09 (“Oil traders price in coronavirus-driven recession”, Reuters, Feb. 28).

But too much commentary, especially in the West, focuses on China’s supply-side role as an exporter of manufactured products, under-estimating its importance on the demand side.

Chinese consumption has become critical as its fast-growing middle class drives demand for everything from cars, consumer electronics and food to international services such as tourism.

Western commentators continue to frame China mostly as an export-oriented processing economy, importing raw materials then re-exporting them as manufactured products.

While that may have been true in the late 1990s and early 2000s, it is no longer an accurate and representative picture.

China has shifted from a small open economy into a very large continent-sized and much more closed economy in the 2020s.

It has become more like the United States, and quite different from trade-dependent economies such as Japan, Germany or the United Kingdom, or large emerging markets like Brazil.

As a result, China has joined the United States as a generator of shocks to the international economy, while becoming more resilient to shocks originating elsewhere.

GLOBAL ENGINE

And like the United States, international trade has become less central to China (https://tmsnrt.rs/2VEMCpp).

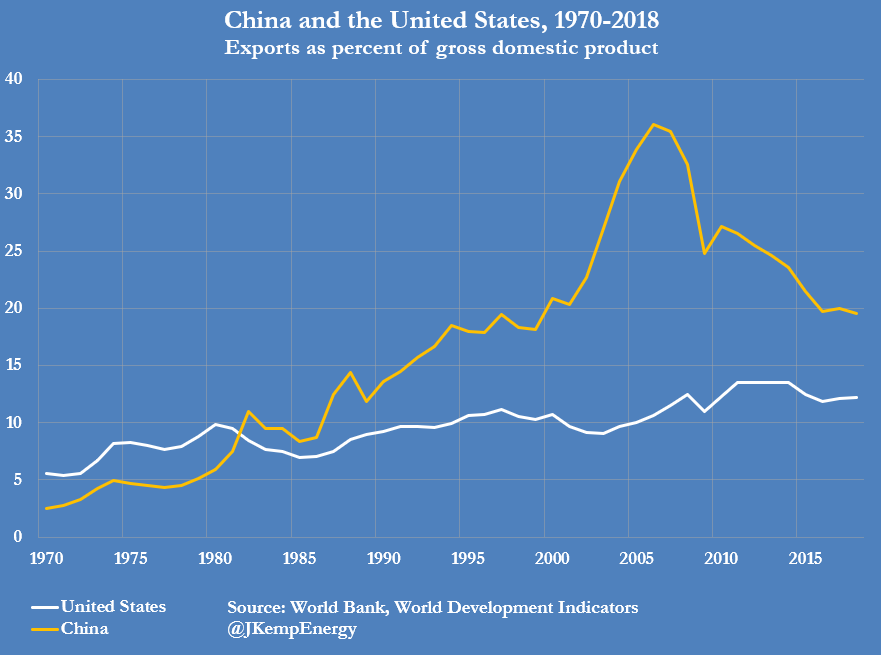

Chinese exports accounted for almost 20% of gross domestic product in 2018, down from a 2006 peak of 36%, World Bank data shows.

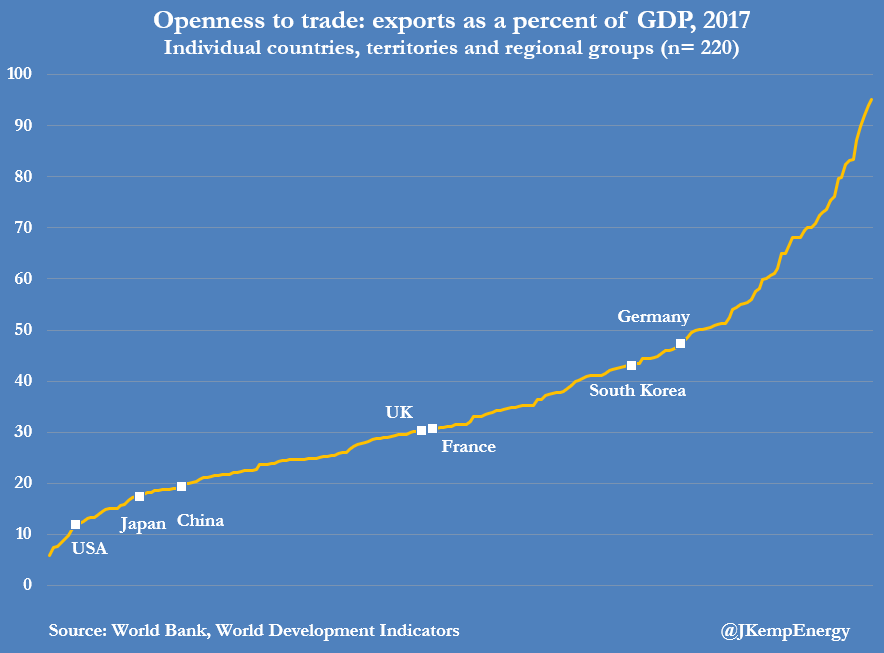

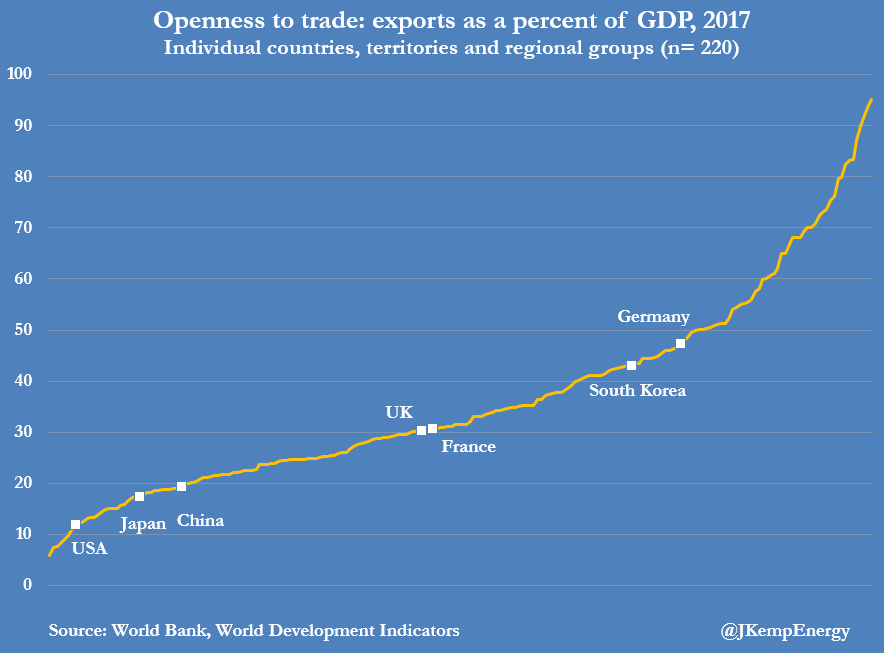

China’s export orientation is not far above the United States (12%) and well below Britain and France (30%) let alone South Korea (43%) and Germany (47%).

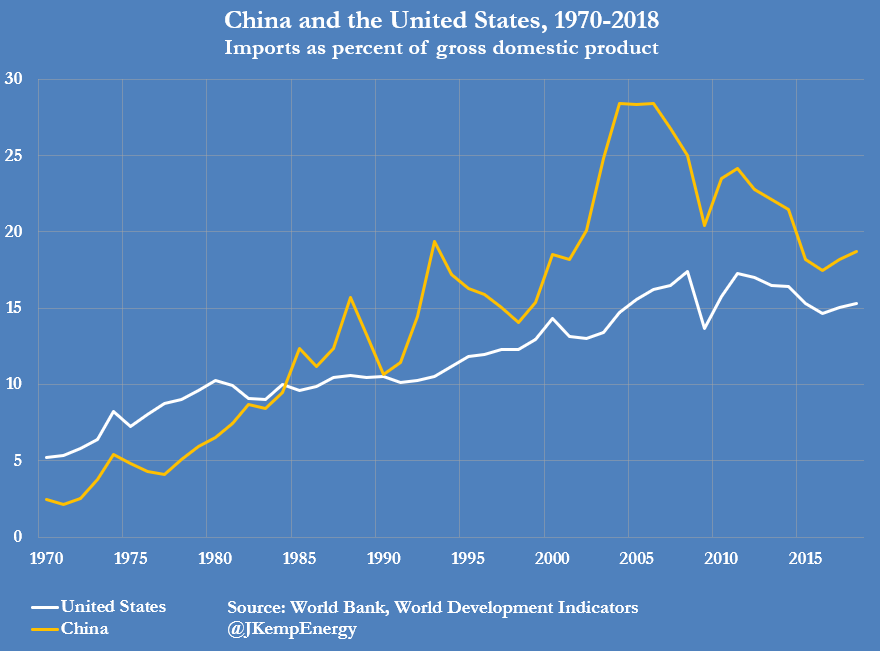

Its imports accounted for 19% of GDP in 2018, down from 29% in 2006, and not far above the United States at 15% (“World development indicators”, World Bank, March 2020).

Nonetheless, despite its increasing domestic orientation, China’s economy plays an increasingly central role in the world system because it is both very large and growing rapidly.

While it may not be particularly reliant on imports or exports, its sheer size means it is capable of sending shockwaves across the globe.

China accounted for almost 30% of all global output growth between 2013 and 2018, International Monetary Fund data shows.

China’s contribution to global growth was bigger than the next two economies, the United States (12%) and India (12%), combined (“World economic outlook”, IMF, Oct. 2019).

In cash terms, China’s merchandise imports increased at an average annual rate of 1.8% per year over the five years from 2013 to 2018, more than twice as fast as import growth in rest of the world at 0.7%.

On the services side, China’s outbound tourism increased by almost 11% per year or a total of 70% between 2012 and 2017, according to the World Tourism Organization.

By contrast, outbound tourism from the United States grew by 8% per year and from the United Kingdom by just 6% per year over the same period.

China accounts for an increasing share of global final demand, so when its economy is hit by a recession, credit tightening or epidemic, the consequences are inevitably transmitted to firms and employees around the world.

DOUBLE CORE

Most western economic commentators still employ a core-periphery model, with the United States at the core (sometimes expanded to include the OECD) and emerging markets and commodity exporters on the periphery.

For decades it was a simple but reasonably accurate heuristic. Shocks tended to be transmitted from the core to the periphery rather than the other way around, for example when the U.S. Federal Reserve raised interest rates.

In recent years, however, China has emerged as a second core, not quite as large or as decisive yet, but almost as capable of generating shocks.

China’s economic slowdown in 2014/15, which contributed to a simultaneous global slowdown in manufacturing and commodity markets, was an early indication of this growing global impact.

Coronavirus has underscored how Beijing’s policy decisions, in this case public health policy, quarantines and business shutdowns, can now impact the rest of the world.

The country’s growing impact on the global economy is most obvious in commodity markets such as oil and iron ore but is also increasingly evident in manufacturing and services such as tourism and aviation.

Western commentators have focused on the supply chain impact of coronavirus, for example the disruption to its exports of face masks and smartphones.

But an equal and probably larger impact will come from the loss of China’s own consumption.

MARKET SIZE

China’s growing internal market also has implications that will last far beyond the coronavirus epidemic, shaping the global balance of power through the middle of the century.

The U.S./China trade conflict has centred on manufacturing production and imbalances in merchandise exports, which has led to a distorted view of the long-term economic and strategic balance.

In reality, U.S. economic dominance over the last 150 years has stemmed from the unsurpassed size of its internal market, which dwarfed competitors such as the Britain, Germany and Japan.

Market size allowed the United States to create dominant manufacturing and services firms, in part through the provision of selective protection, investment controls, procurement preferences and regulatory standard-setting.

In contrast to Britain, Germany, Japan or the Soviet Union, China is the first competitor for more than a century with a similar-sized domestic market.

It is China’s vast internal market, not its exports, that makes it a formidable competitor, reshaping the global economy.

Related columns:

– Oil traders price in coronavirus-driven recession (Reuters, Feb. 27)

– Coronavirus and the impact on oil consumption (Reuters, Feb. 5)

– Oil consumption tracking is all about Asia (Reuters, Dec. 12)

– China has replaced U.S. as locomotive of the global economy (Reuters, Nov. 5)

(Editing by Alexander Smith) |